If you look at our recommendations, our Analysts have always recommended various Diversified funds. We had received few e-mails last year on how we missed the opportunity in IT Specific funds. Well Investors, we were the first one to burn our fingures in Sector specfic funds, especially in IT sector in 2000. [Gul Tekchandani’s Sun Emerging IT fund, Samir Arora’s Alliance IT Fund etc]

If you look at our recommendations, our Analysts have always recommended various Diversified funds. We had received few e-mails last year on how we missed the opportunity in IT Specific funds. Well Investors, we were the first one to burn our fingures in Sector specfic funds, especially in IT sector in 2000. [Gul Tekchandani’s Sun Emerging IT fund, Samir Arora’s Alliance IT Fund etc]

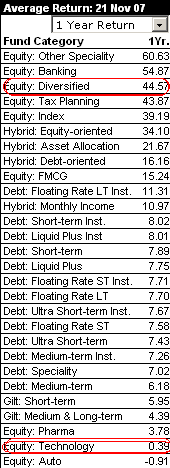

Now in the image to your left, you can see yourself the returns IT specific funds have given in the past one year Vs Diversified Equity funds.

IT Funds – 0.39%

Diversified Funds – 44.57%

A Year ago IT funds were at 55% and Diversified Funds were again at 40%.

The focus of our investment advise is for disciplined investors who are serious to create wealth. Now to share the insider information, the fund managers of Diversified funds are also very smart. When they feel Banking or Capital Goods stocks are going to rise, they go for the top 5 stocks in the sector and ride the boom and exit. It is not that they are not participating at all.

Happy Investing!!!

Lehman Brothers, was the first one to Downgrade the Indian IT companies and we were the first one to report it here. Lehman has now come up with recommendations on the Indian FMCG space.

Lehman Brothers, was the first one to Downgrade the Indian IT companies and we were the first one to report it here. Lehman has now come up with recommendations on the Indian FMCG space.